Defining virtual staging

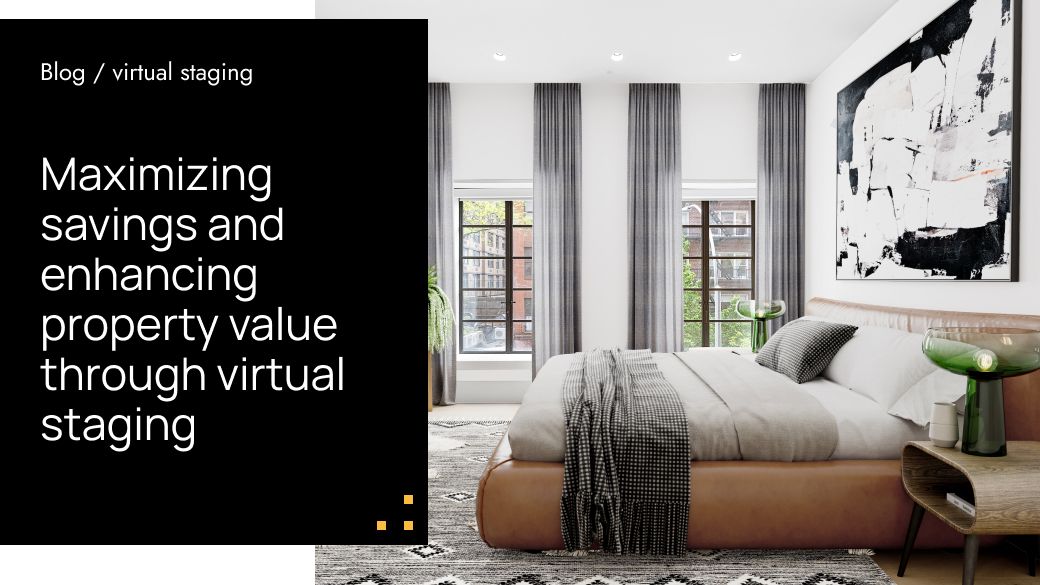

Known as virtual or digital staging, this is a process of filling empty spaces with furniture and accessories using professional computer software. People have heard much of actual staging when sellers of vacant homes purchase new furniture and decor to make them more appealing to potential buyers. In fact, virtual staging is the same process of developing a comfortable interior in an empty room using real furniture pieces, however, everything is done with the help of a computer. There are thousands of high-quality models that can be used to enhance photos of vacant homes and experienced architects and designers create exclusive solutions to make listings viewed much more frequently.

Why is virtual staging needed?

Virtual Staging is used in many industries but the real estate business has made the most of this service nowadays. It is very popular to showcase property online nowadays but potential buyers prefer to view staged homes to empty ones. Virtual Staging is the most effective way to attract more attention to vacant homes and speed up sales. Viewers are hooked by a beautiful picture of an interior and get interested in the home for sale due to that. Another reason to use virtual staging is to help people visualize space.

Only 10% of people understand the real size of an empty room and can imagine what furniture pieces can fit it perfectly. The rest see nothing except for bare walls, so all the interior objects serve as a hint for people and they can easily comprehend the message with their help. Digital staging is often ordered by real estate agents to sparkle interest and it copes with this responsible task perfectly.

Why is there no alternative to virtual staging?

There are many marketing strategies used in real estate but virtual staging is a number-one approach to selling vacant homes. The reason for that is a wide range of benefits this service has:

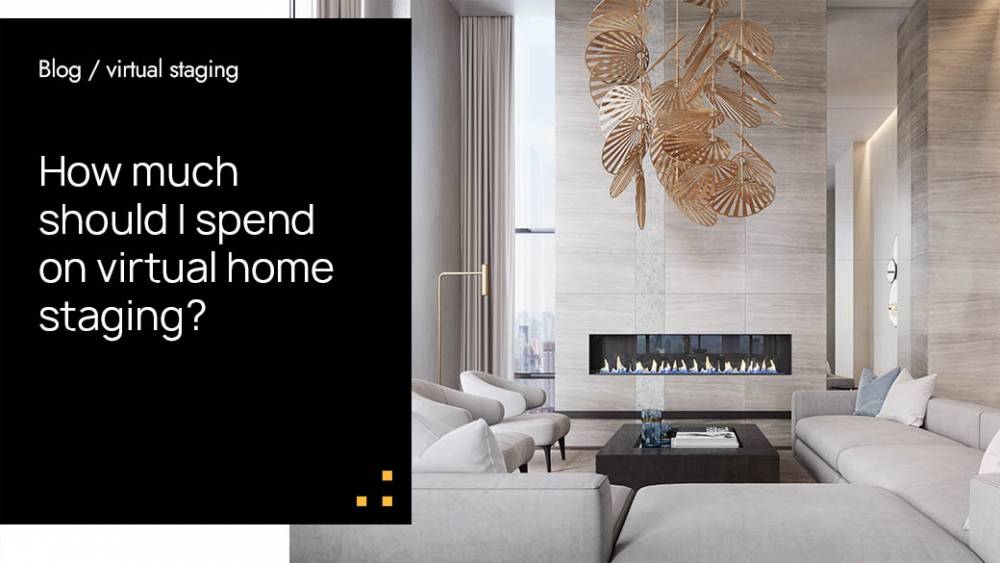

Cost-effective: the price of virtual staging services is 1% or less of the cheapest actual staging budget.

Fast delivery: it takes from a couple of business days to a week to get all the photos staged.

Flexibility: the possibility to try on multiple interior styles, apply changes, and use photos in multiple ways. Simple order process: usually, it is enough to send photos of empty rooms by mail and pay for services to make an order.

Additional solutions

Virtual staging services can be also used to declutter, depersonalize or make changes to the room design. Thanks to these and many other benefits of digital staging, an empty property is no longer considered to be problematic and is sold twice faster without delays. Naturally, virtual staging services are offered by many companies nowadays, but many clients get disappointed with the quality of photos delivered. If you want to get truly realistic and breath-taking images, be careful with the choice of the staging team and turn to experts in this field.

Virtual Staging: what’s special about it?

Average buyers always face a problem when they need to envision what kind of interior design is the best for every empty room. Only 1 in 10 people are capable to imagine that, so the majority will look for professional assistance in the companies that offer actual or so-called physical staging services. They hire an interior designer who will develop a unique interior design for an exact room and select furniture pieces to match it. This service is especially popular with real estate agents who sell empty homes and try to enhance them with actual staging solutions to sell them faster. However, when this home acquires a new owner, it transforms into the same vacant and faceless space since all the furnishing is removed again.

Now it is clear that the purpose of both actual and virtual staging coincide - they aim at promoting rapid sales. However, there is still a great difference between these solutions: physical staging will cost you around $5,000 - $7,000 while 3D home staging is much more affordable: the price differs depending on the company ranging from $60 to $200 per photo.

How does virtual staging work?

The first thing a person thinks about when he sees a photo of a beautiful and trendy interior inside the home for sale is how he and his family will enjoy happy living there. It means that virtual staging is a powerful marketing approach that impacts buyers’ decisions at the psychological level.

But how exactly is digital staging performed in practice? According to Andrew Zlobin, Spotless Agency CEO, professionals who conduct 3D staging services should provide 3 essential details:

- Real photos of the property. Realtors often prefer to hire professional photographers to get quality images of rooms with the right choice of angles and lighting and send these photos to the staging company.

- Reference images. Designers should understand what every client expects to see and what his tastes are when it comes to the choice of furniture, interior style, room functionality, etc. Trusted digital staging companies offer clients free enhancements to achieve 100% customer satisfaction without extra payments.

- Property layout (floorplan). This information is necessary to guarantee a correct scaling and achieve the highest level of realism.

What is the key to excellent virtual staging results?

It goes without saying that technical peculiarities play an important role to deliver brilliant results but the key to the success of every project is education, experience, professionalism, skills, and talent of the designers and virtual stagers who work on the project. They should have not only degrees in Architecture and Computer Design but also have an excellent command of the leading visualization, 3D virtual staging, and similar tools and software that may be useful in the provision of advanced virtual staging solutions.

One more important thing in the processing of virtual staging orders is time. Reputable companies try to provide premium solutions within 24 hours only if the number of photographs is not big. Naturally, the waiting period can be a little longer but still, a turnaround time is much faster than in actual staging - only several days.

It is predictable that virtual staging is an innovative solution that will soon replace physical staging in the real estate business and many other spheres. It has lots of benefits for customers and is an efficient marketing approach that evokes the best associations and impressions about the empty property.